- Home

- Personal

- Credit Cards

- Mastercard World Elite

Mastercard World Elite

Experience a suite of exclusive benefits designed to make your life easier and more convenient. The Mastercard World Elite provides peace of mind with tailor-made benefits that cater to your everyday needs and luxurious desires.

Apply

Rewards & Benefits

General Rewards

Benefit from exclusive day to day discounts, savings, and conveniences.

- National Bank of Bahrain’s Personalised Lifestyle Specialist: Access to MasterCard Concierge TENgroup for personalised service.

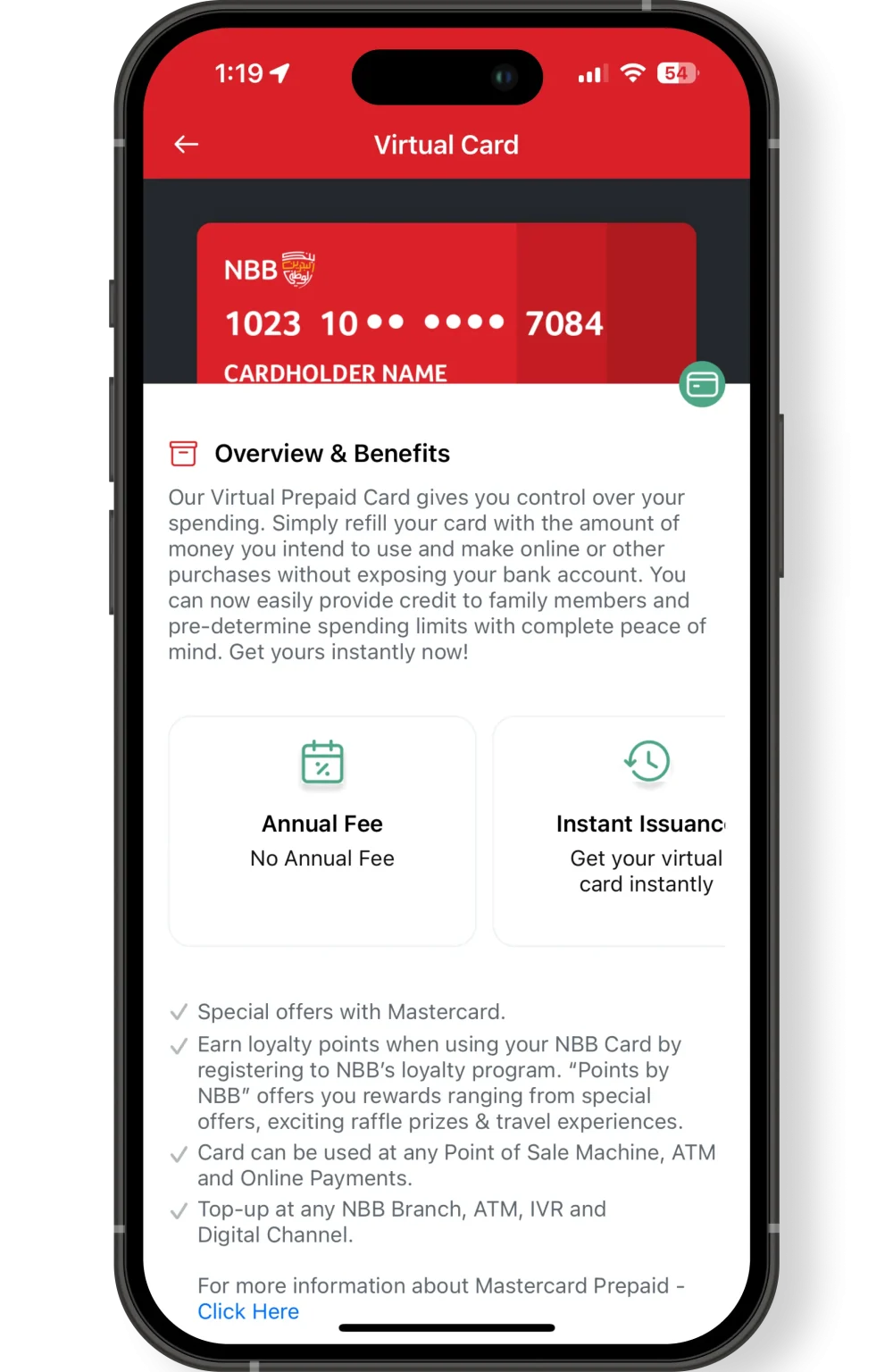

- Dedicated Application: Enhance your travel experience with essential tools and information.

Additional Benefits

Competitive and flexible benefits for additional peace of mind.

- Attractive Cash Advance Rates: Competitive rates on cash advance facilities.

- Low Monthly Interest: Competitive monthly interest rates at 1.75%.

- Interest-Free Period: Enjoy up to 51 days interest-free on purchases.

- Flexible Repayment: Convenient repayment options, paying only 5% of the balance due or BHD 10, whichever is higher.

- Contactless Payments: Payments through contactless Tap & Go service.

Travel Rewards

Enjoy exclusive convenience, comfort, discounts, and so much more while traveling.

- Complimentary Lounge Access: For the cardholder and one guest at over 1,200 airport lounges worldwide.

- Comprehensive Travel Protection: Enjoy compensation for loss of baggage of up to USD 3,000, delay of baggage up to USD 300, and personal accident insurance coverage up to USD 500,000.

- Careem Chauffeur Services: Premium travel services at your fingertips with Careem with 6 free rides annually.

- Flexiroam: Stay connected with free mobile data service while traveling.

- Comprehensive Life & Travel Insurance: Protect yourself and your family with coverage for medical expenses, evacuation, trip delay, baggage delay, and more when you book your trip with your Mastercard World.

- Car Rental Discounts: Save up to 35% with AVIS, up to 15% off with Hertz (use promo code CDP814540), up to 10% with Budget, and up to 10% with rentalcars.com.

- Travel Visa Assistance Services: Streamlined support for your travel visa needs.

- VAT Reclaim Services: Global Blue aims at enhancing the international shopping experience with added-value services for travelers, such as:

- Global Blue City VIP Lounges: Complimentary access to Global Blue City VIP Lounges to receive VAT right back.

- Complimentary Airport Fast Track: Complimentary access to the Global Blue fast track services at the Airport VIP Fast Lanes available at the refund points.

- Tax Free Forms: Automatic completion of the Tax Free Forms upon registering for Shop Tax Free Card when shopping at a participating Global Blue merchants.

- Booking.com: Get 10% cash back on bookings.

- Global Hotel Alliance: Benefits at hotels, resorts, and luxury serviced apartments.

OneFineStay & Soneva Luxury Resorts: Benefit from special offers and discounts. - IHG Hotels & Resorts: Enjoy exclusive discounts on stays.

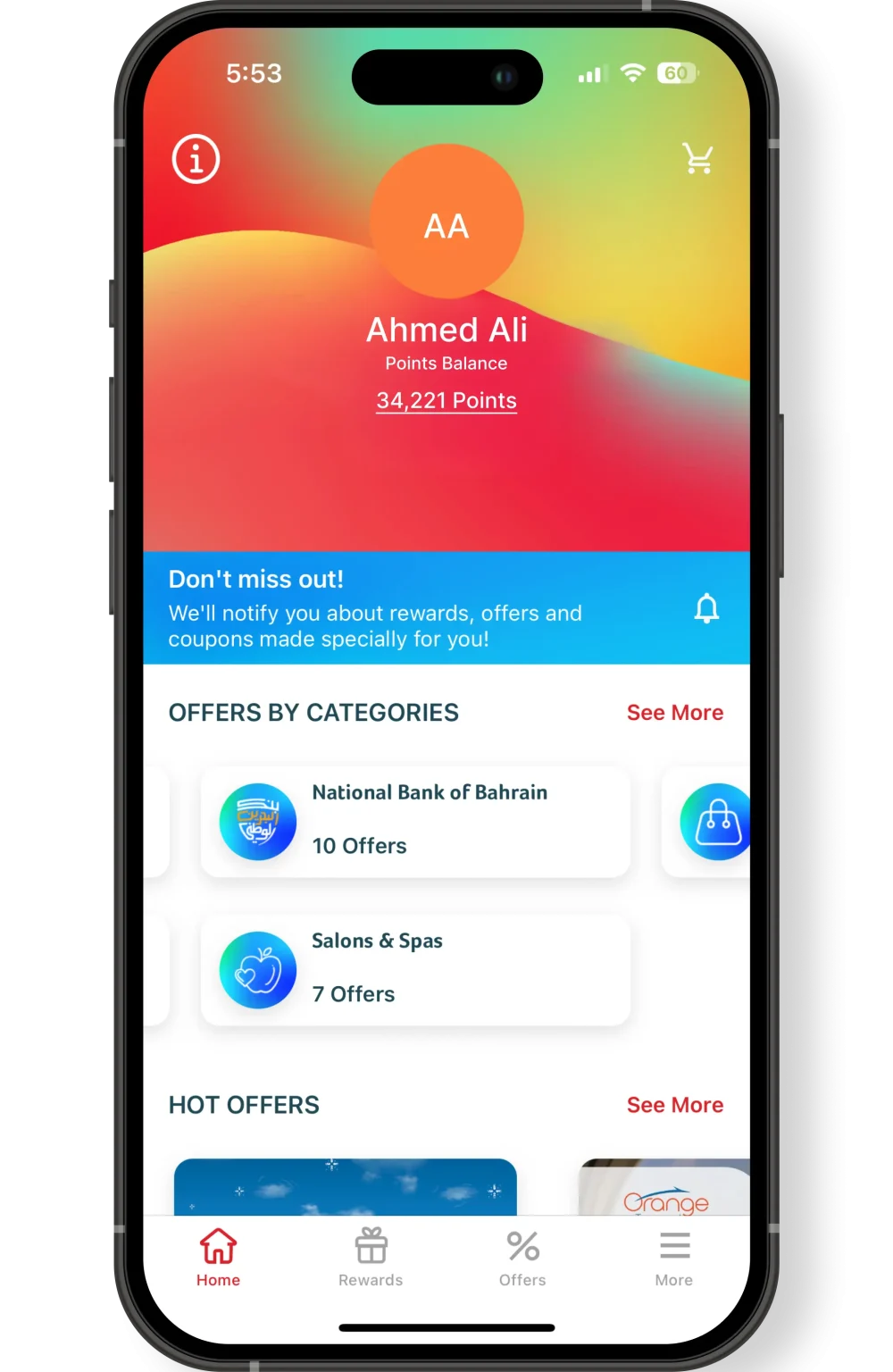

Points

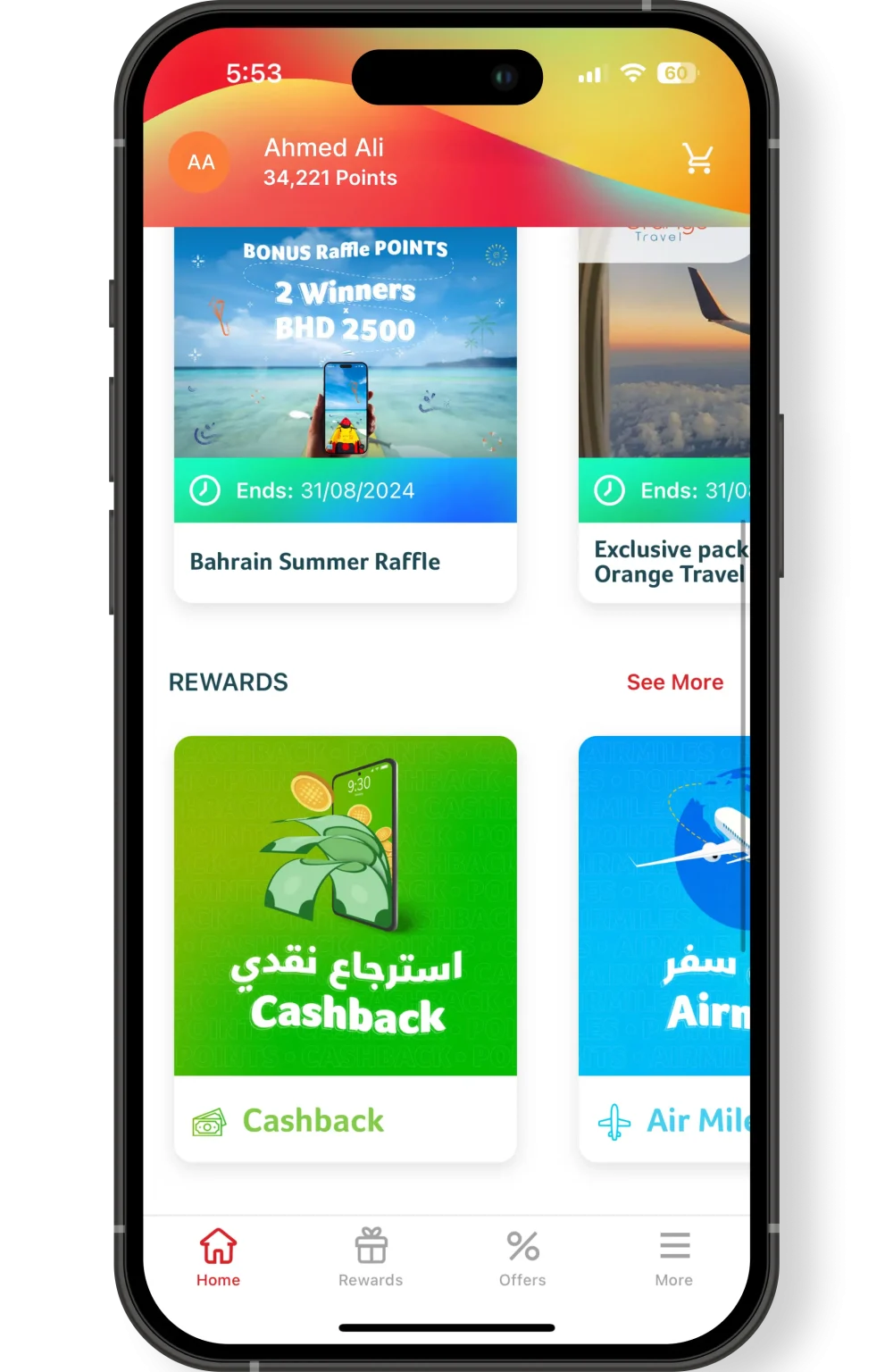

Earn while spending on a daily basis with the exclusive Points programme.

- Access: Simply download the Points by NBB app, receive 100 welcome points, and start getting rewarded. Track your points, redeem rewards, and stay updated on the latest offers and promotions all in one place.

- Rewards: Earn 1 Base Point for every BHD 0.500 spent locally, BHD 0.450 internationally, and BHD 3 for all government and special category spending.

- Double Points: #Double_Up Your Points on select dates and holidays.

- Exclusive Discounts & Offers: Use your points to enjoy significant discounts and offers on a wide range of products and services.

- Air Miles: Convert your points into air miles and travel the world with ease.

- Cash Back: Receive cash back directly into your account for added financial flexibility.

Process

A seamless and easy process to get your credit card and start enjoying your every day.

-

Prepare Documents

Prepare the required documents for this type of account after checking your eligibility.

-

Download Application

Download NBB Digital on your smartphone and apply for a card easily. You can also visit one of our many branches to apply.

Eligibility

The different eligibility criteria you need to meet to open this type of credit card.

-

Bahraini

This credit card is available to Bahraini citizens over the age of 21.

-

Non-Bahraini Residents

This credit card is available to non-Bahraini residents over the age of 21.

Required Documents

The required documents needed for this type of credit card.

-

Bahraini

You will require a valid government-issued Identity Card (CPR) or two alternative IDs, latest salary slip (proof of income), an original salary certificate, a 3-month account statement (6 months if self-employed), and an outstanding letter (if any).

-

Non-Bahraini

You will require a valid government-issued passport, valid residency permit, and a valid identification document, latest salary slip (proof of income), an original salary certificate, a 3-month account statement (6 months if self-employed), and an outstanding letter (if any).

Let us know, we’d be more than happy to help and support, reach out to us

Terms & ConditionsPoints

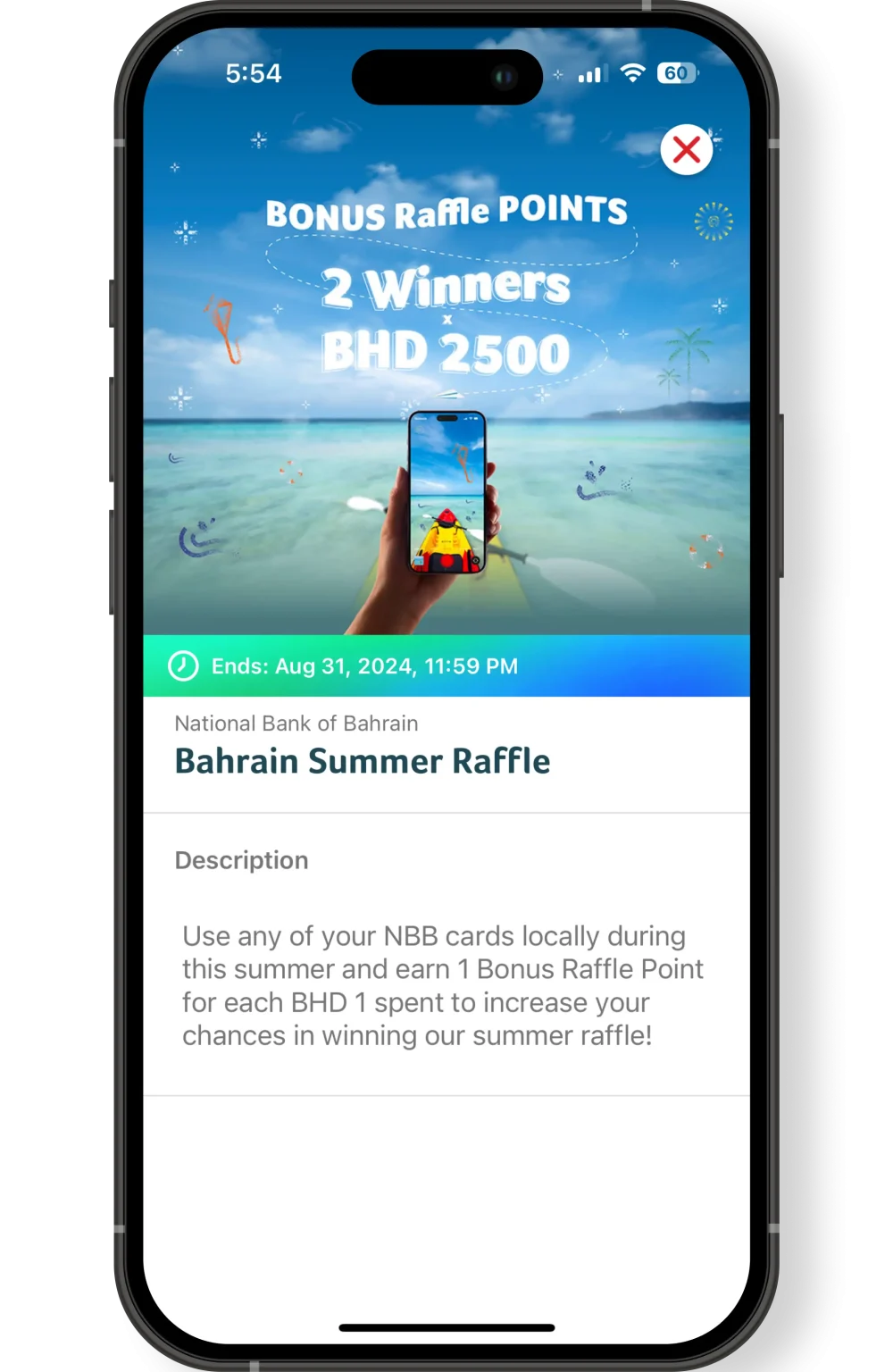

Earn Base and Bonus Raffle points when you spend with Points for exclusive offers, valuable raffle prizes, air miles, products, and cash back or donate points to local causes. To start earning, download Points by NBB, login or register, and enjoy!

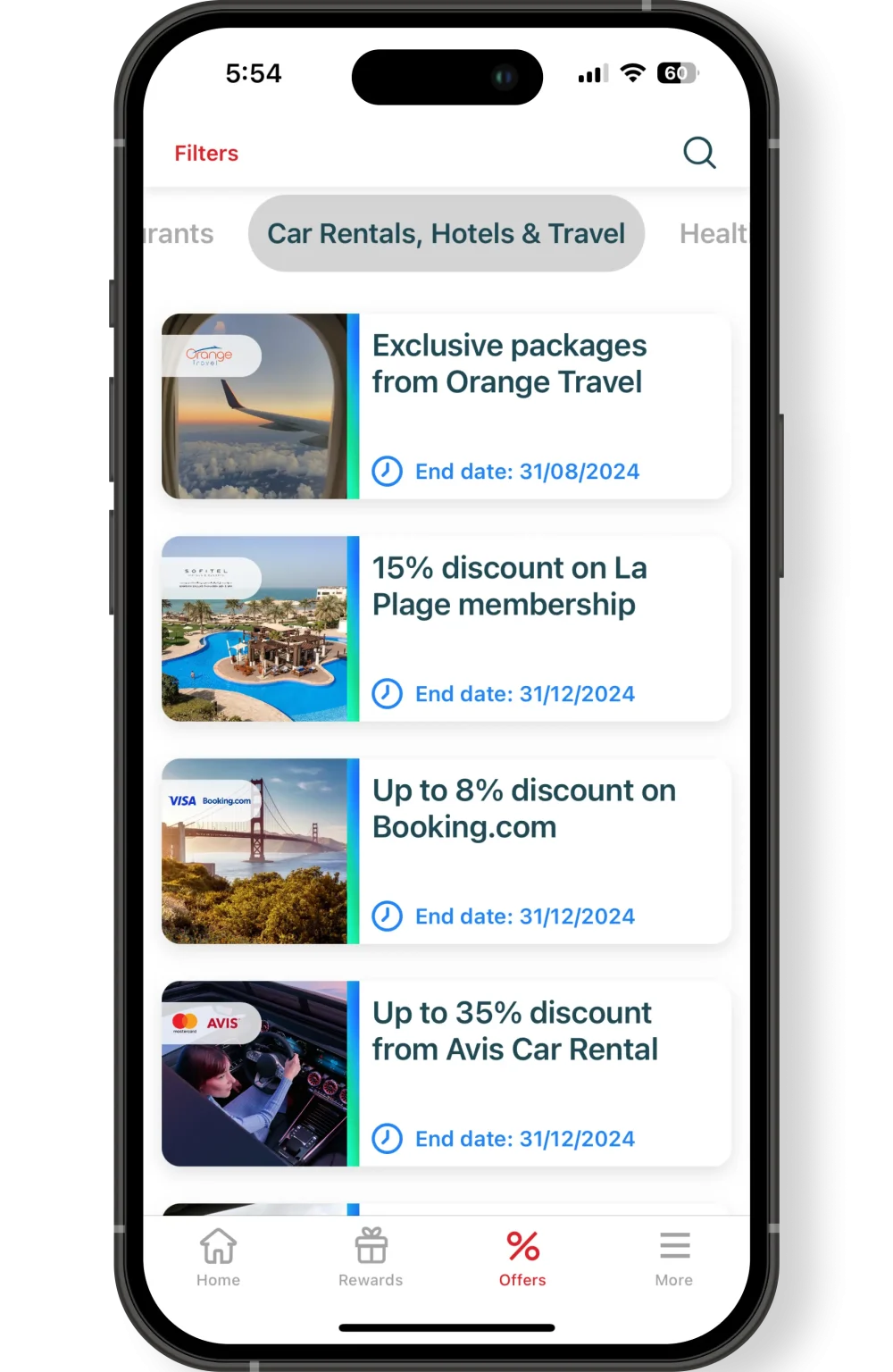

Exclusive Offers

Enjoy your points to get access to a variety of offers and experiences from our partners, just for you.

Valuable Prizes

Use your points to enjoy significant discounts, prizes, and air miles for your upcoming dream trip.

Air Miles

Convert your points into air miles, travel the world, and enjoy your dream trip with ease.

Attractive Cash Back

Receive cash back directly into your account for added financial flexibility.

Let us know, we’d be more than happy to help and support,reach out to us.

Terms & ConditionsBanking Channels

Discover diverse and secure banking methods, ensuring a seamless and accessible experience tailored to your preferences and convenience.

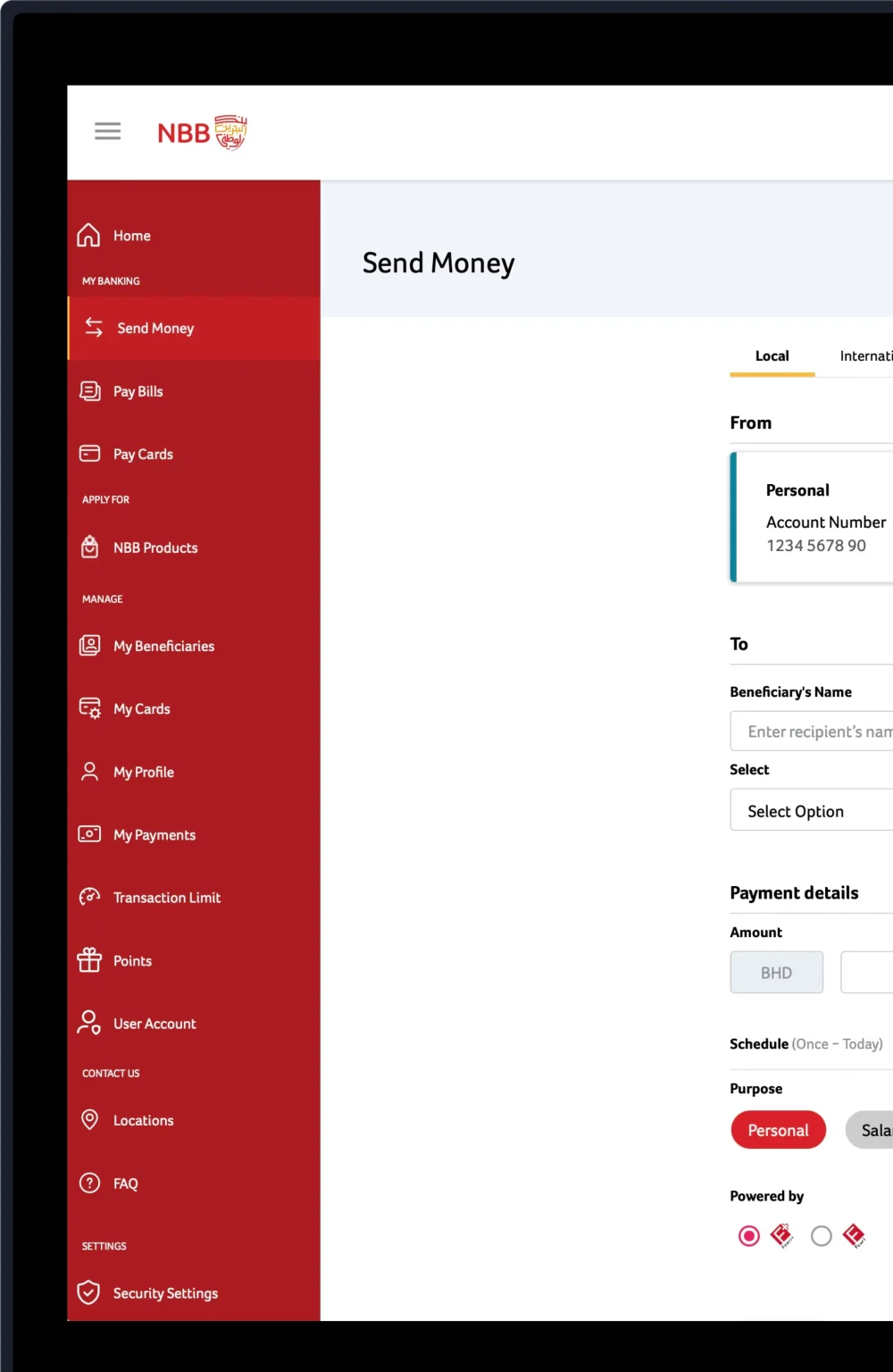

Digital Banking

Bank on the go with our NBB Digital app, offering secure and convenient access to your accounts, and transactions.

Branch Banking

Visit the nearest branch and get your banking needs met through one of our representatives. They’ll be happy to help.

Online Banking

Experience seamless financial management with easy access, advanced features, and more.

Phone Banking

Conveniently manage your finances over the phone, offering easy access to account information, and assistance.

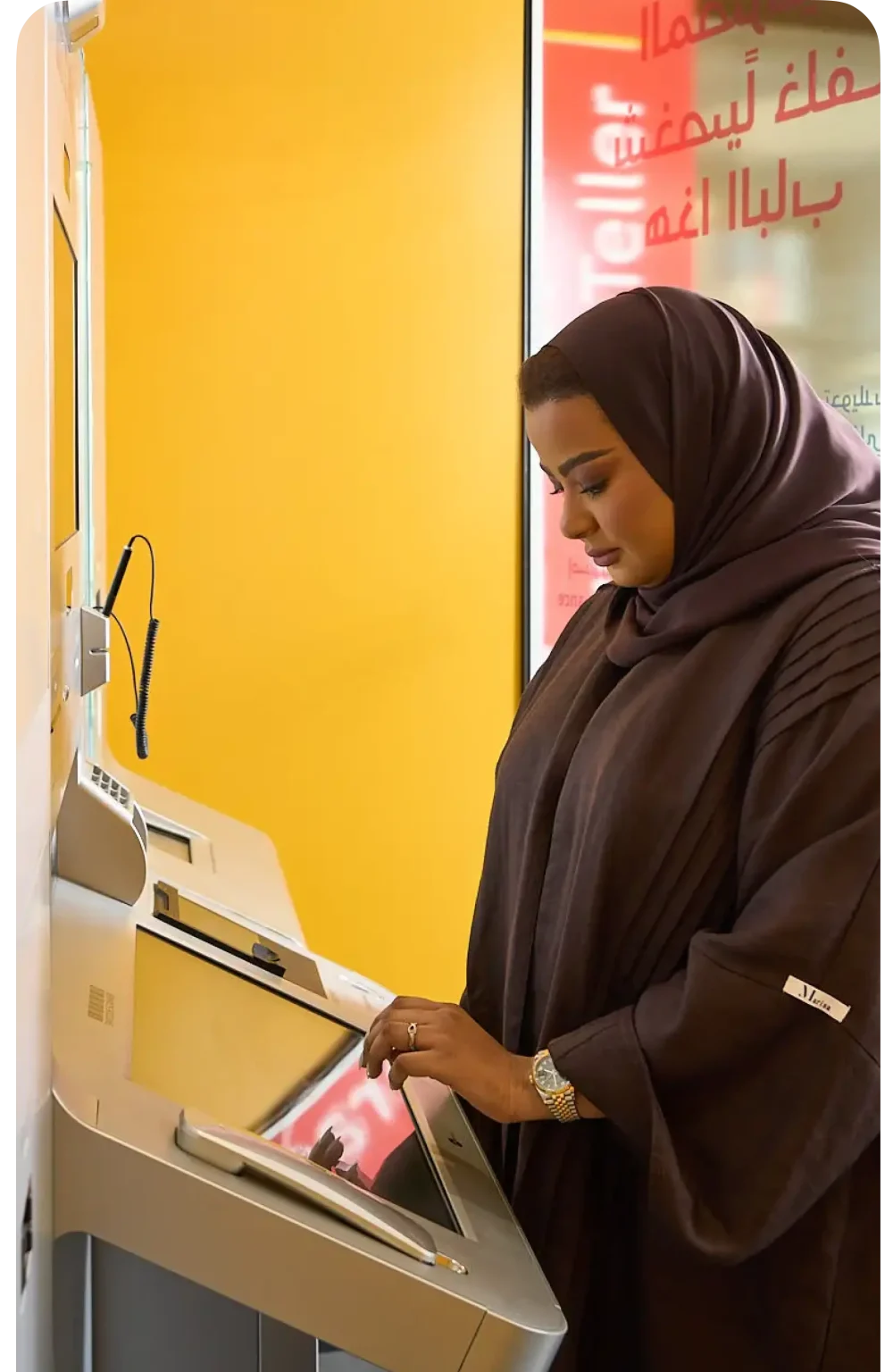

Interactive Teller Banking

Use an interactive teller, accessible all day, at flagship branches. Get statements, account details, cheque books, and cards printed.

Let us know, we’d be more than happy to help and support,reach out to us.

Terms & Conditions